CoreLogic's National Home Value Index rose a further 0.9% in October, accelerating from a 0.7% rise in September.

Since finding a trough in January, the National Home Value Index has increased by 7.6%, leaving the index only 0.5% below its historic high recorded in April of last year.

At this rate of growth, we're likely to see the National Home Value Index reach a new record high midway through November, recovering from the 7.5% drop in values recorded through the downturn between May 2022 and January 2023.

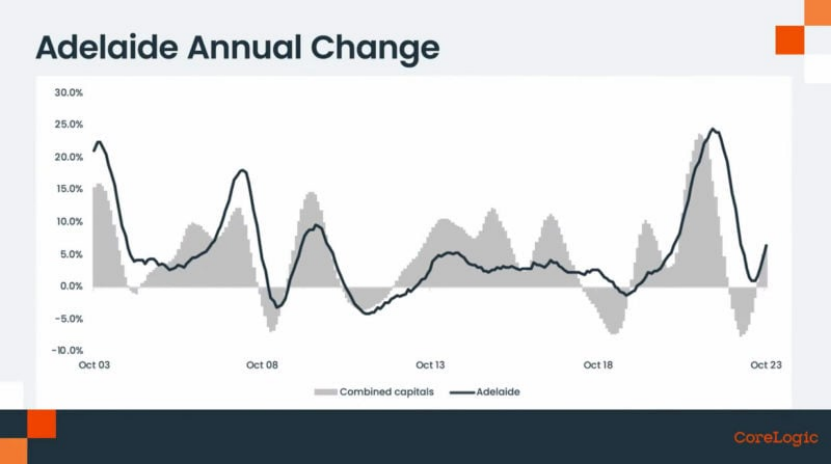

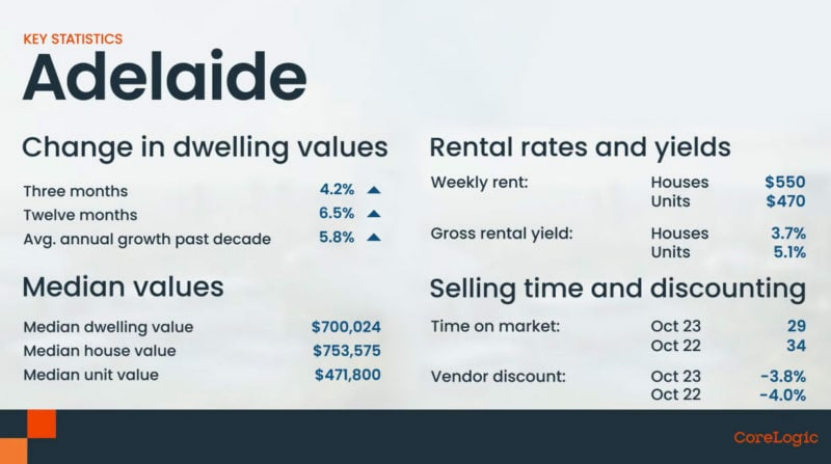

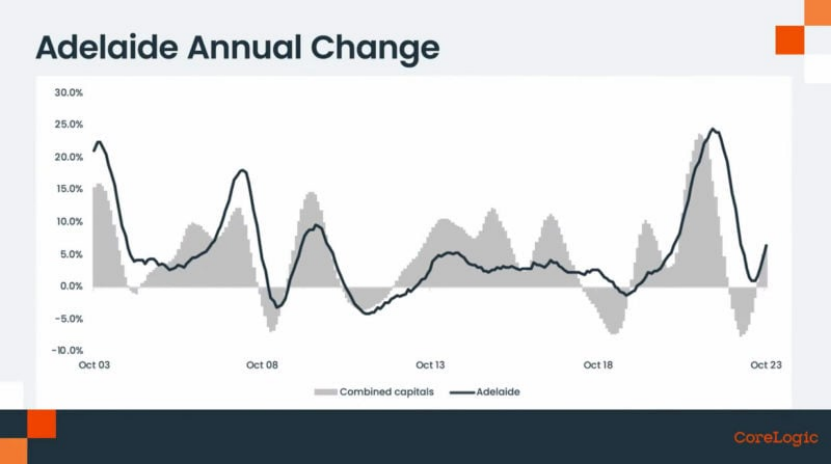

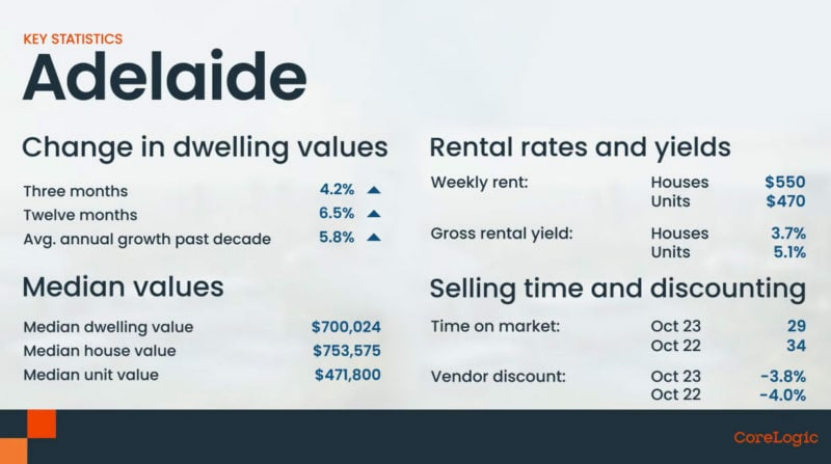

Housing values across Adelaide increased by $9,100 in October, or 1.3%.

Although housing values are consistently rising across most capital cities, there has been a slowdown in the quarterly pace of growth.

Adelaide Housing Market Update | November 2023

Since finding a floor in March, housing values are up 7.7%, posting a new record high each month since June.

Dwelling values rose across each of the capital cities, except Darwin through the month, with Perth, Brisbane, and Adelaide as the top-performing markets.

Perth and Adelaide are also at new record highs after recovering from the shallower downturns earlier this year.

House values are rising a little faster than unit values, up 4.2% and 3.8%, respectively, over the past three months.

Regional markets continue to lag their capital city counterparts, with the combined regional index up 0.7% in October, compared with the 0.9% rise across the combined capitals.

The trend in advertised stock levels remains a critical feature of the housing market.

After 10 months of below-average vendor activity, the flow of new capital city listings has ramped up through winter and spring to be almost 12% higher than a year ago.

Although total listings remain lower than this time last year, and below the previous five-year average, it's clear that inventory levels are rising.

Advertised stock levels have hardly budged through spring, holding almost 40% below the 5-year average for this time of the year, despite a 20% rise in the flow of new listings coming onto the market.

Capital city stock on the market is up 5.1% since the start of spring, in a clear indication that buyer demand isn't keeping pace with the flow of new listings.

However, the balance of advertised supply remains diverse around the country.

Such low advertised supply demonstrates a strong rate of absorption and strong selling conditions.

While vendor activity has picked up, home sales are tracking only slightly above the five-year average across the capitals and are losing some momentum.

Regional sales are holding reasonably steady but at slightly below-average levels.

With vendor activity gathering some momentum, while buyer activity slows, it's likely selling conditions will continue to rebalance back towards buyers, especially in those cities where advertised supply levels are high.

In markets where demand and advertised supply levels are more evenly balanced, it's logical to expect price growth to slow down.